VAT Profiles

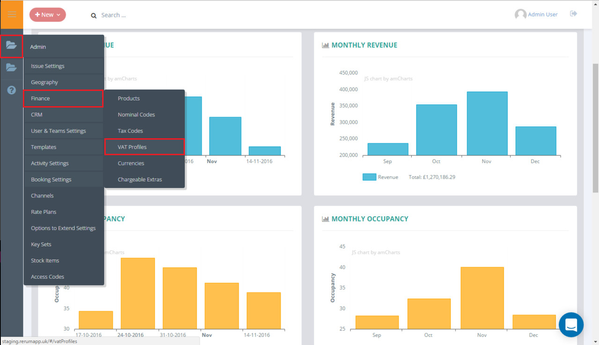

1 - Select Admin > Finance > VAT Profiles.

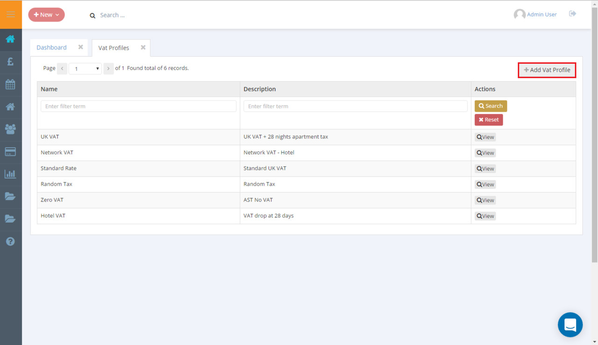

2 - Select 'Add VAT Profile'.

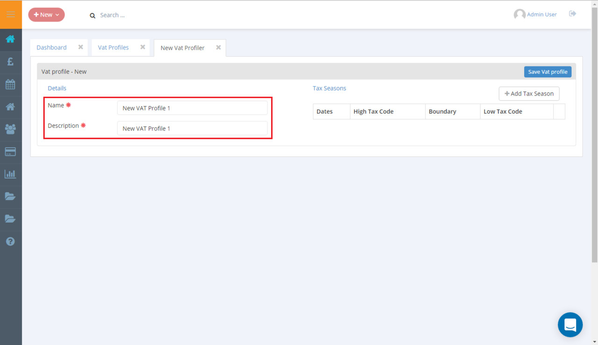

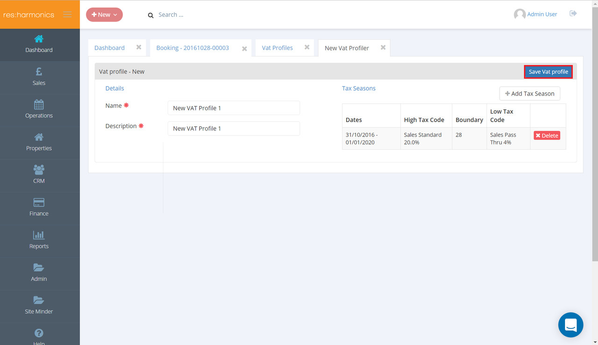

3 - Enter a name and a description for the VAT Profile.

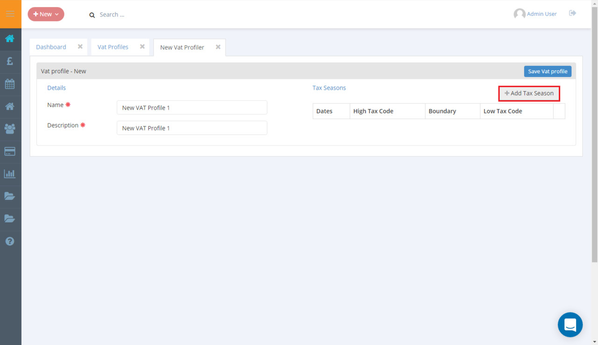

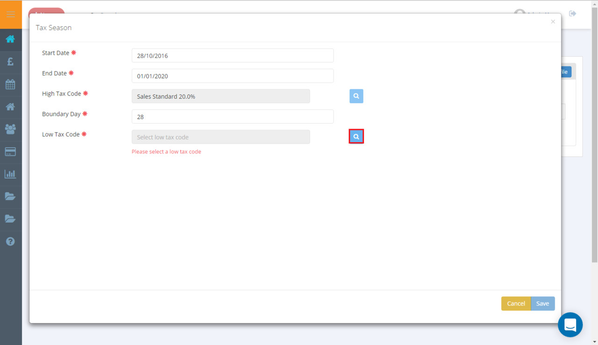

4 - Select 'Add Tax Season'.

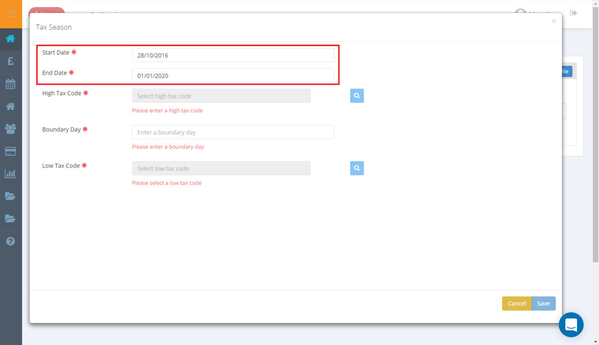

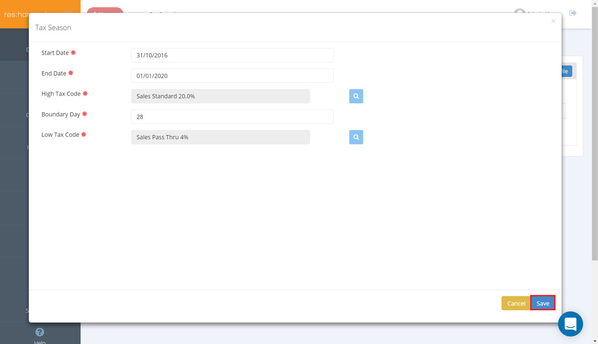

5 - Select the start and end date for the high tax code.

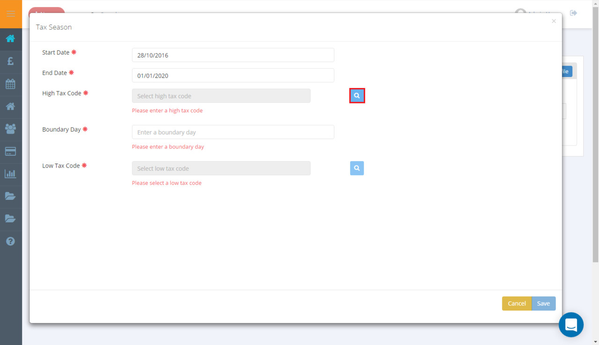

6 - Select the blue magnifying glass to select the high tax code.

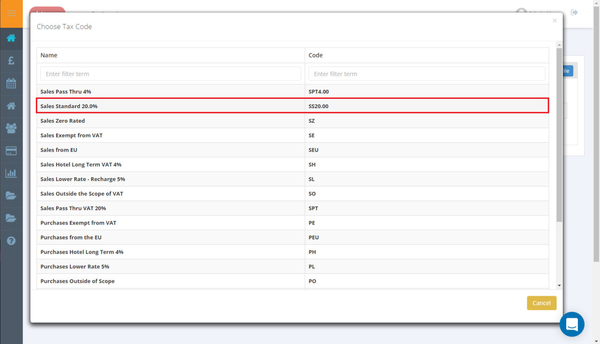

7 - Select the high tax code.

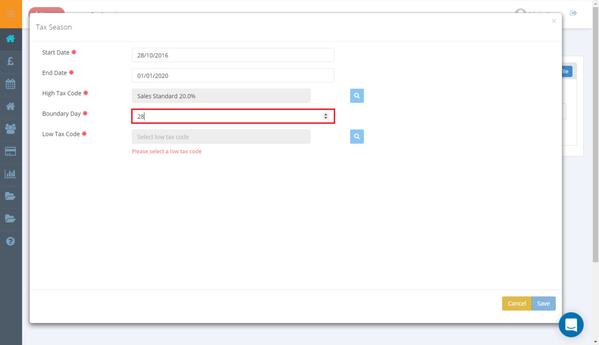

8 - Select the boundary day, after which the tax rate will drop.

9 - Select the blue magnifying glass to select the low tax code.

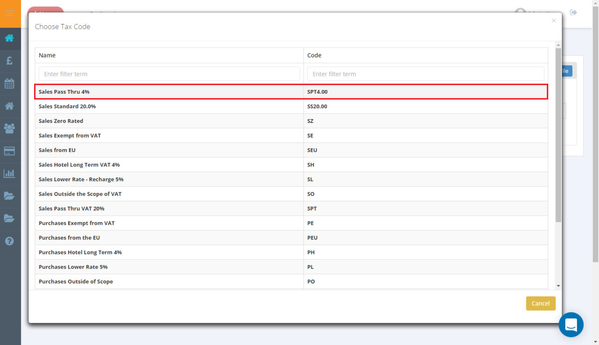

10 - Select the low tax code.

11 - Select 'Save'.

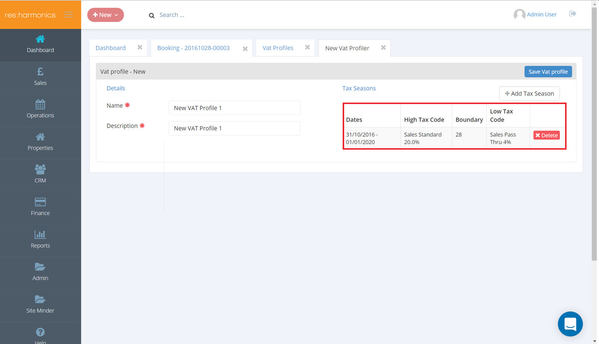

12 - The details you have selected will appear in the 'Tax Seasons' section.

13 - Select 'Save VAT Profile'.

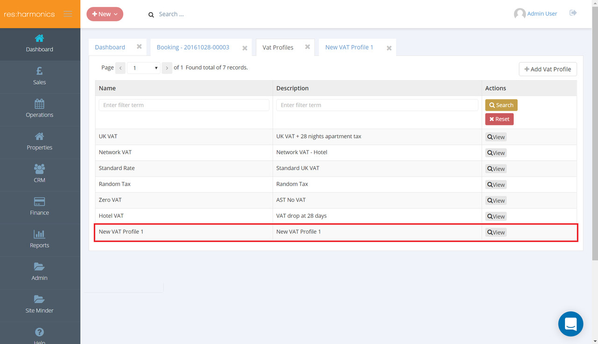

14 - The VAT Profile will then be saved.