Tax Type For Xero Configuration

By configuring the correct tax type within ReRum to match with Xero, this will allow the correct tax to be recognised when transfering invoices and purchases onto Xero.

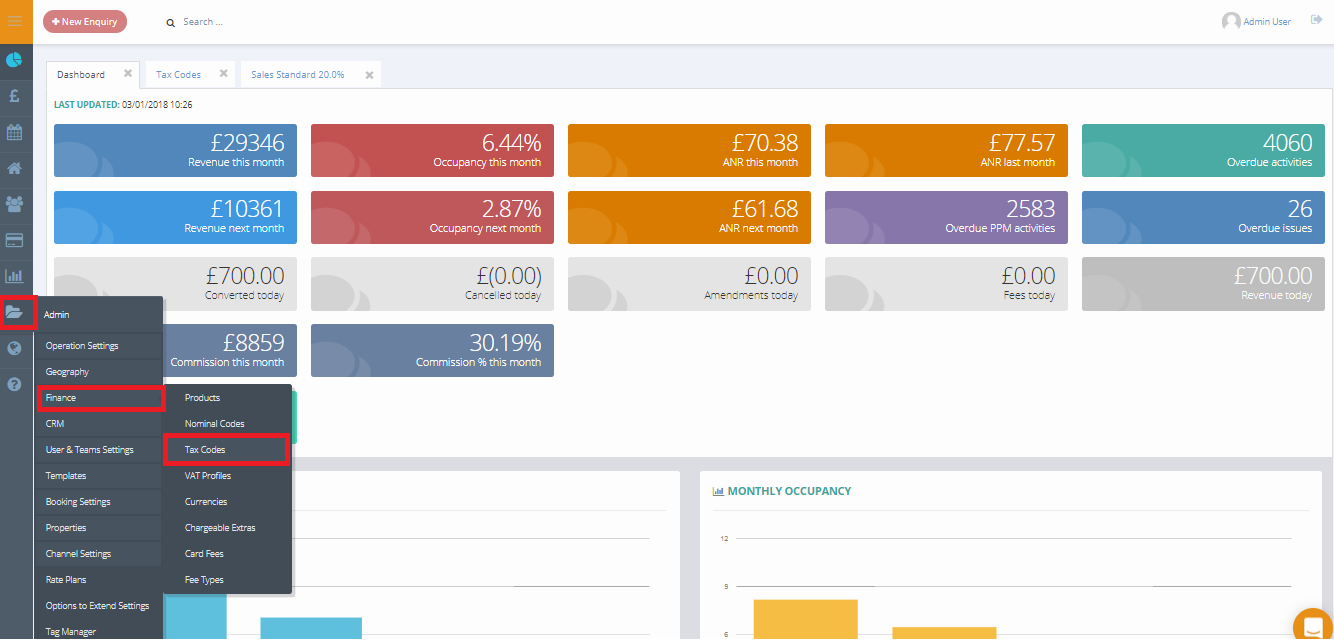

1.To access Tax Codes you will need to open Admin > Finance > Tax Codes.

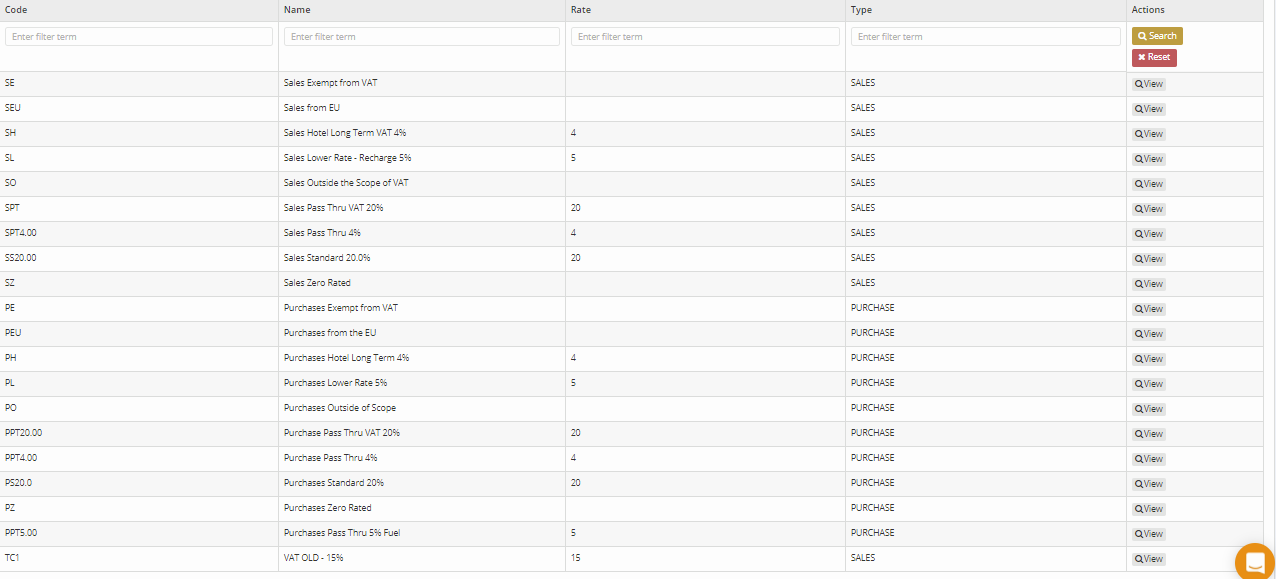

2. You will then open up all the tax codes created and within your system. Within each of these codes they will include a Xero Tax Type.

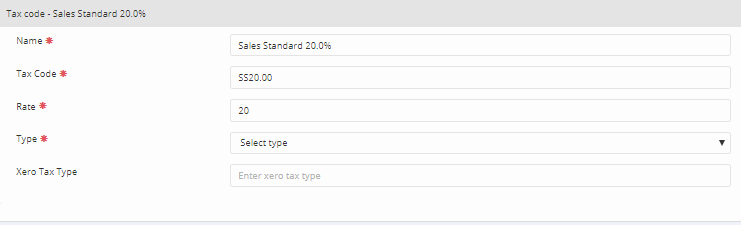

3. As you can see here a new field has been added called Xero Tax Type. This can be configured for each code. Edit the tax code.

4. Xero Tax Types can vary for different tax codes and countries as they are all different.

The U.K's standard are

| INPUT2 - | 20% (VAT on Expenses) |

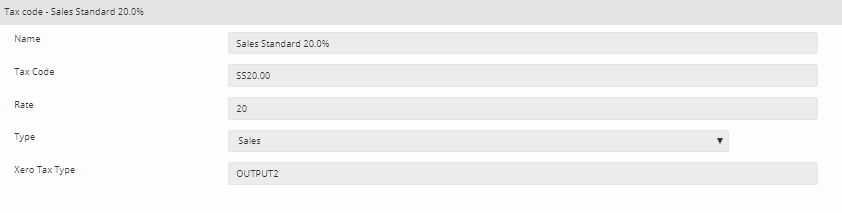

OUTPUT2 - | 20% (VAT on Income) |

These are the basic ones that can be used however with the link below, you can choose different tax types and use tax types from other countries.

https://developer.xero.com/documentation/api/types#TaxTypes

This is an example of how it would look. Once this is done click update.